BBVA Customer Migration

In June 2021, PNC completed the acquisition of BBVA USA making it the 5th largest commercial bank in the United States, servicing customers in 29 of the top 30 largest markets in the country.

So that all of our customers can have a consistent user experience, we converted 1.75 million BBVA USA accounts to Virtual Wallet products and migrated those users to PNC’s online banking.

My team was tasked with creating the experiences to welcome those users, answer their questions about the transition, help them set up their new accounts, and educate them about new features and tools.

Welcome Screen

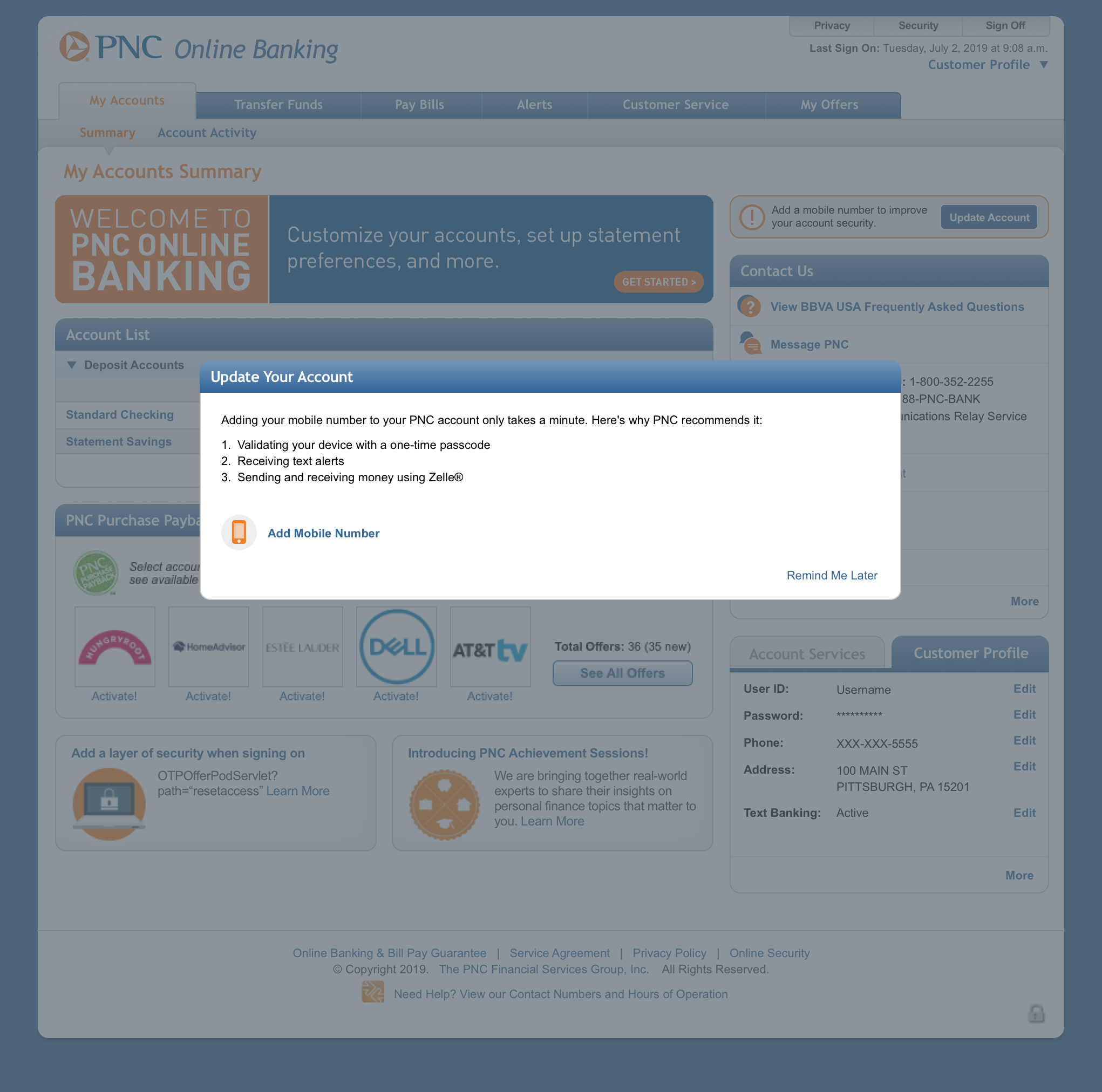

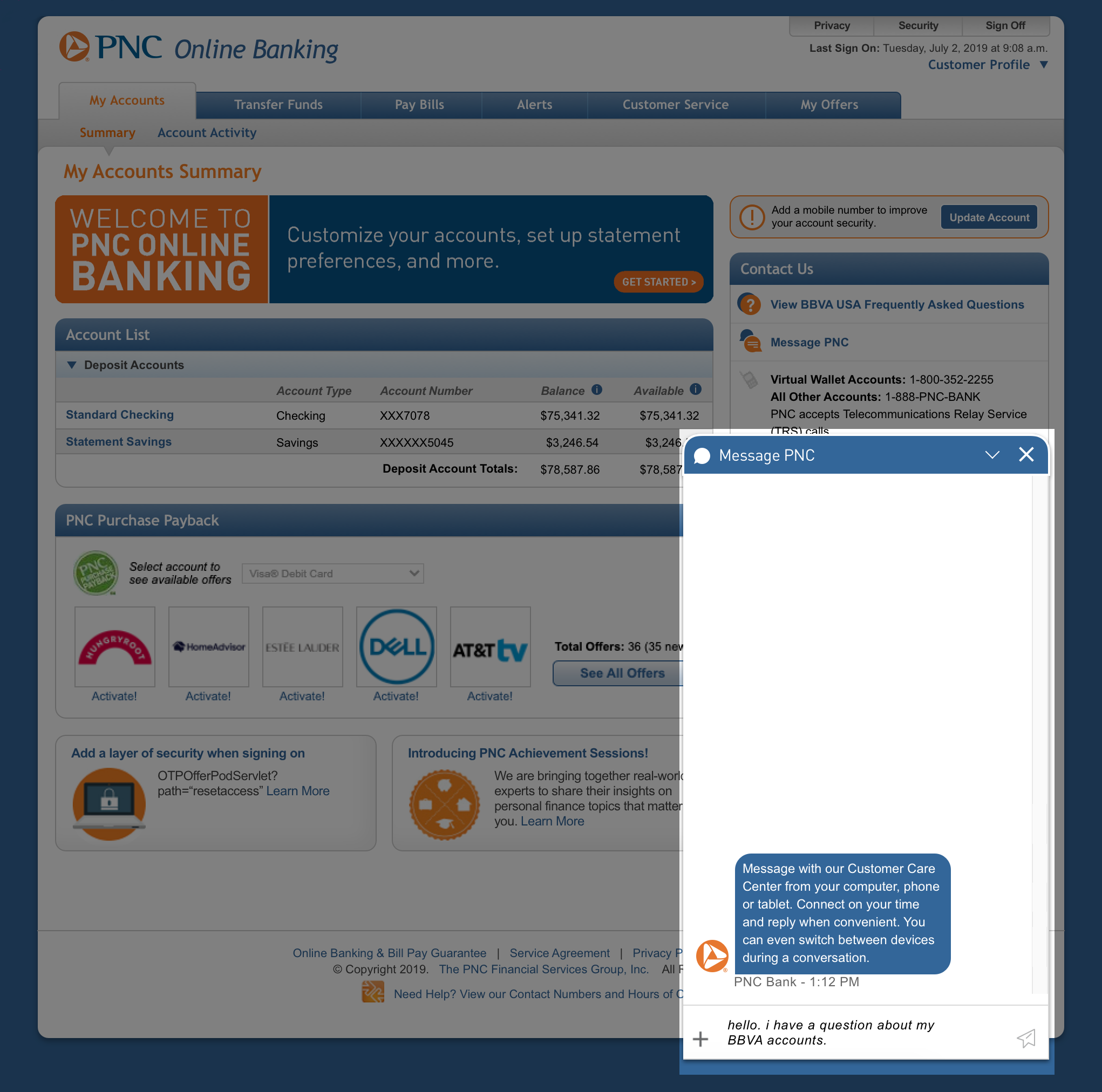

This is the home page that users would see when they logged into PNC’s online banking for the first time.

We hoped to greet migrated customers with a friendly and welcoming tone that encourages exploration and instills confidence that they can find help if they have any questions along the way.

We added a number of elements to the landing screen to let them know about settings that may need to be updated, as well as ways to reach out if they couldn’t find their way.

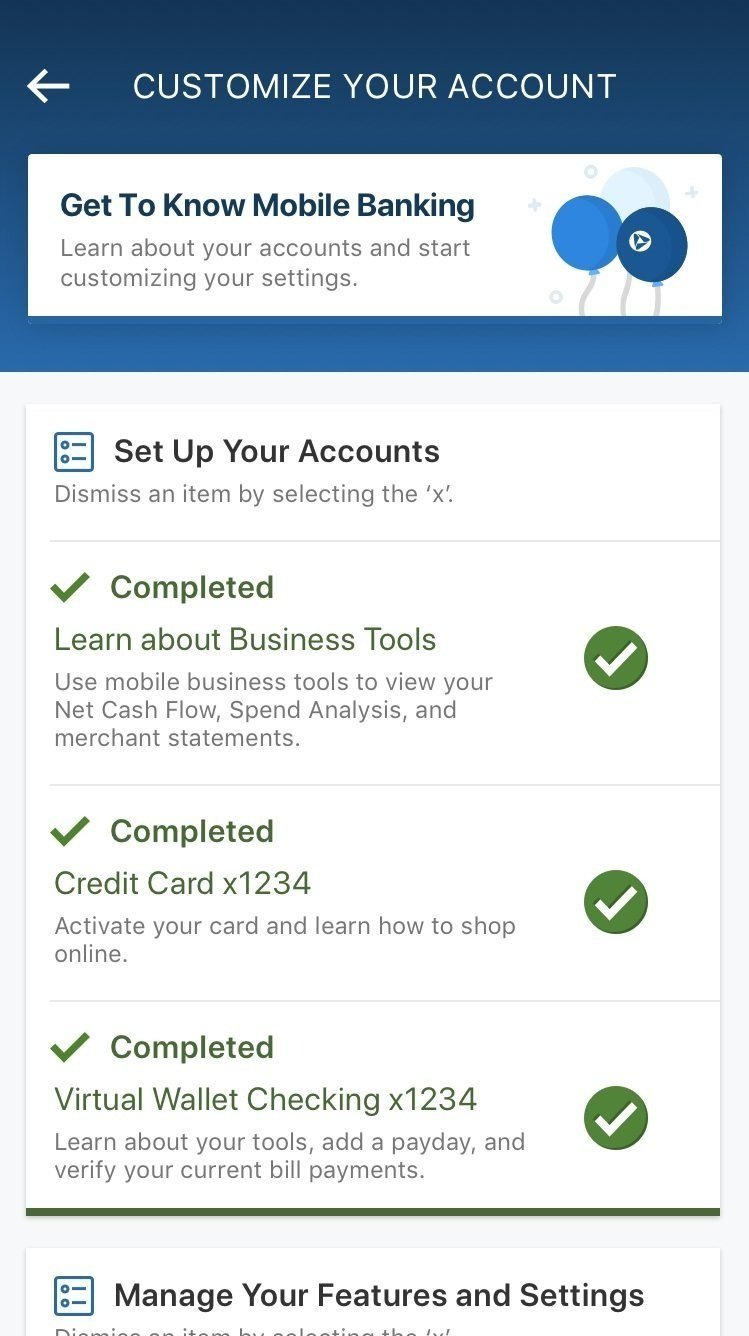

Account Setup Checklist

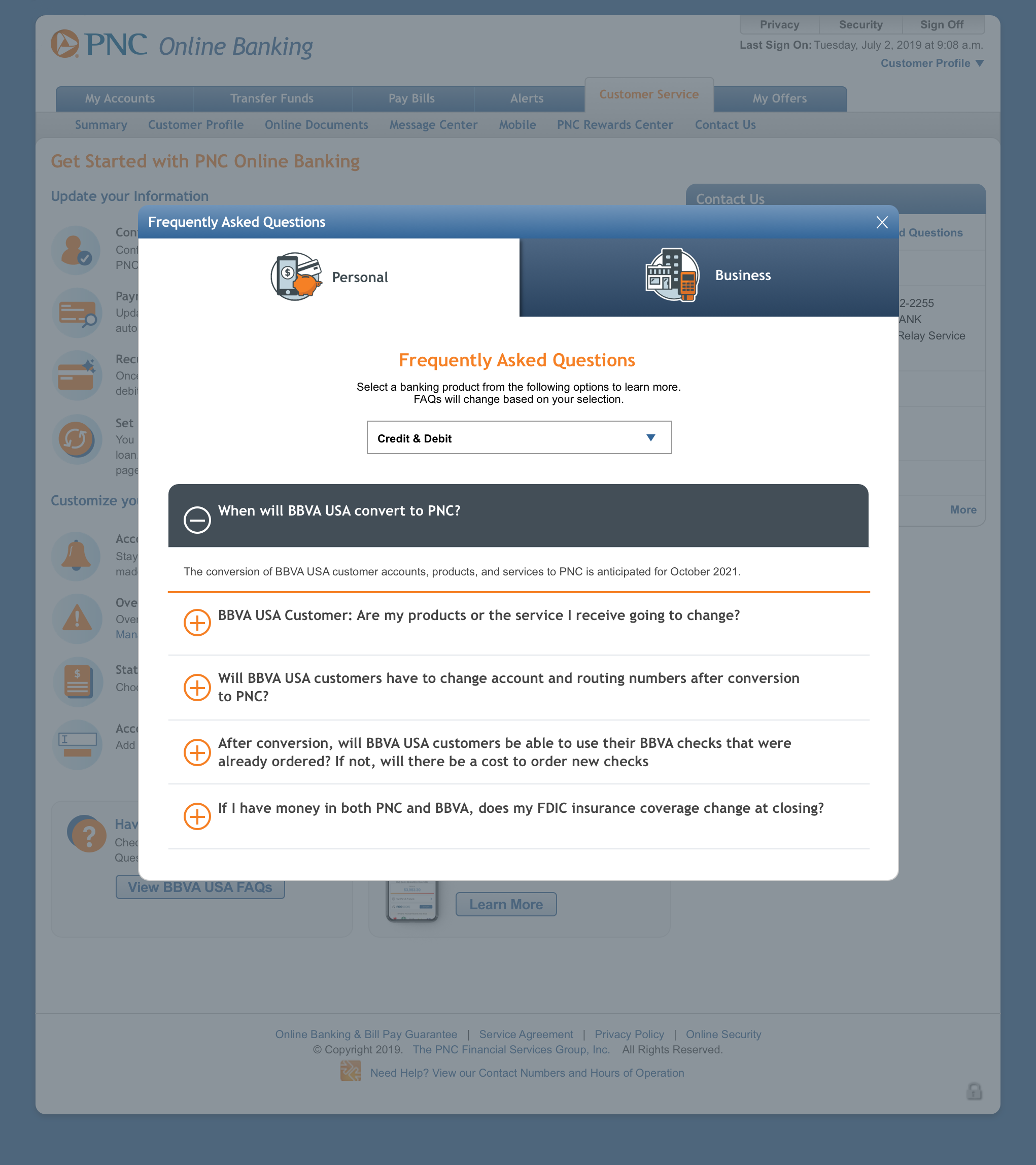

Technical constraints and differing settings meant that not every setting that BBVA USA offered to customers matched up with one that PNC offers. This made it necessary for customer to manually reset some settings like alerts, nicknames, and statement preferences. Clicking on the welcome banner brought you to this account setup checklist that included reminders and links to set those up features and to other new features that BBVA USA didn’t offer.

Virtual Wallet Onboarding

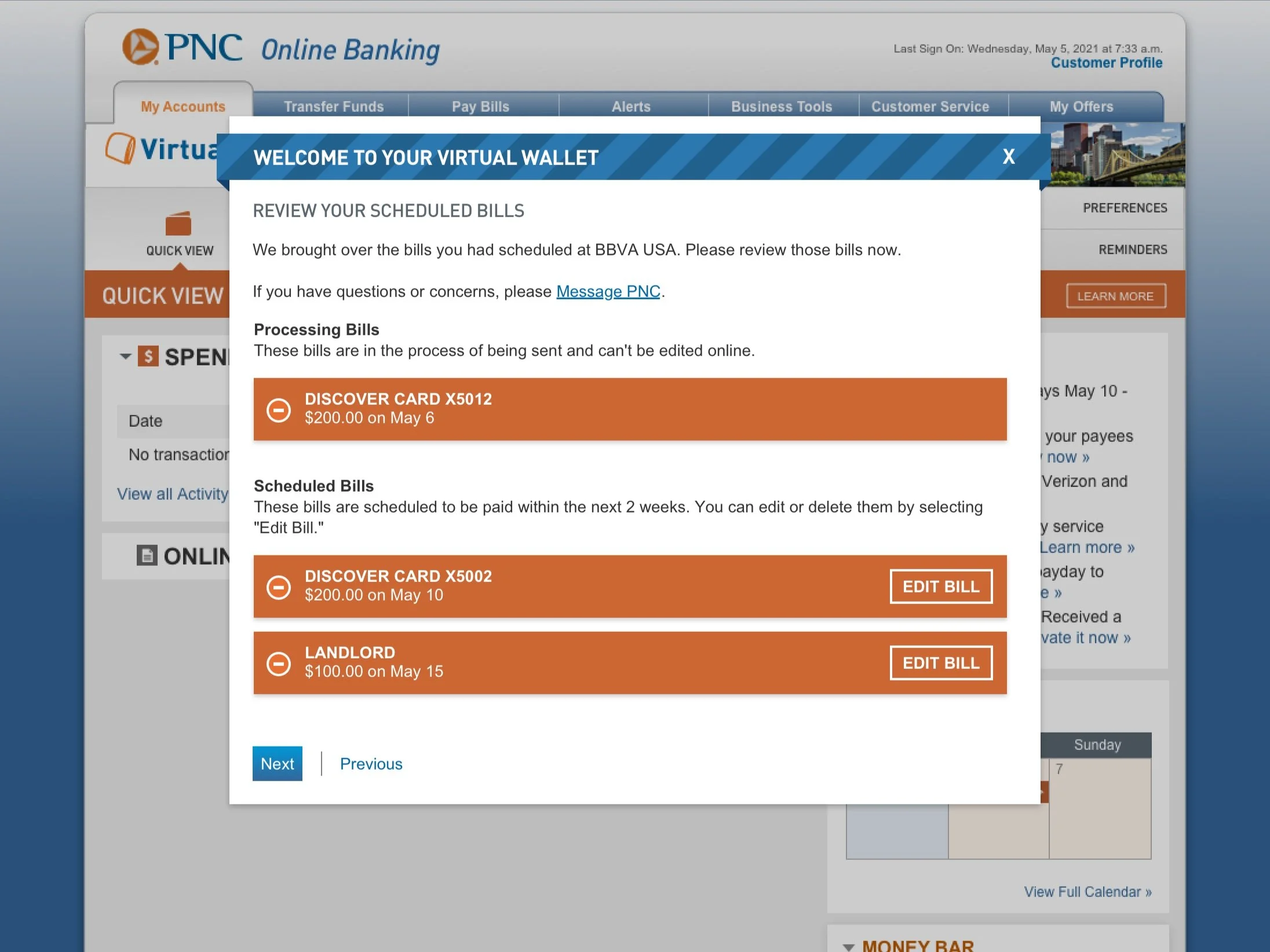

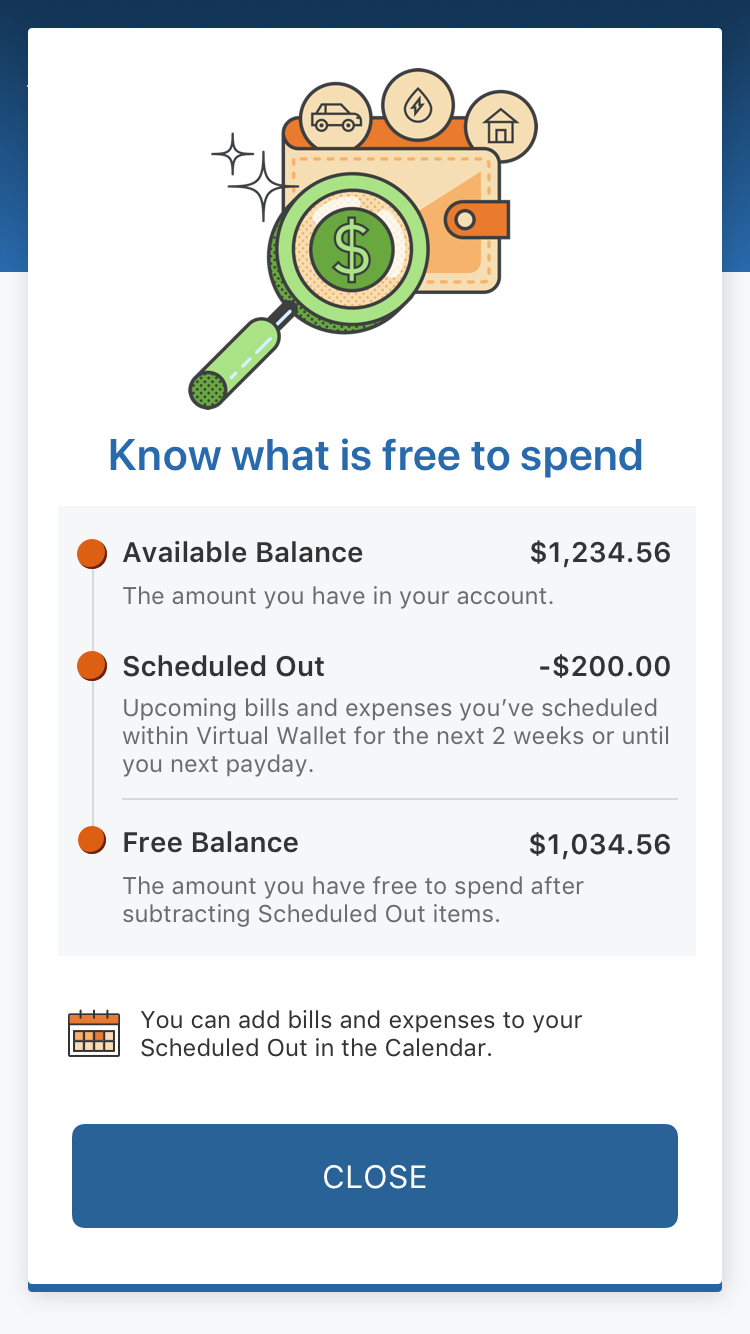

Customers that had a checking account with BBVA had their account converted to Virtual Wallet accounts when they were migrated to PNC. This gave them access to a number of great money management features that they didn’t have before.

Typically users will have learned something about those features during their account opening experience, whether that is via a banker assisting them in branch or on our online application sites. Since these users were migrating and not opening new accounts, we needed an alternate way for them to learn about the offerings of their new account.

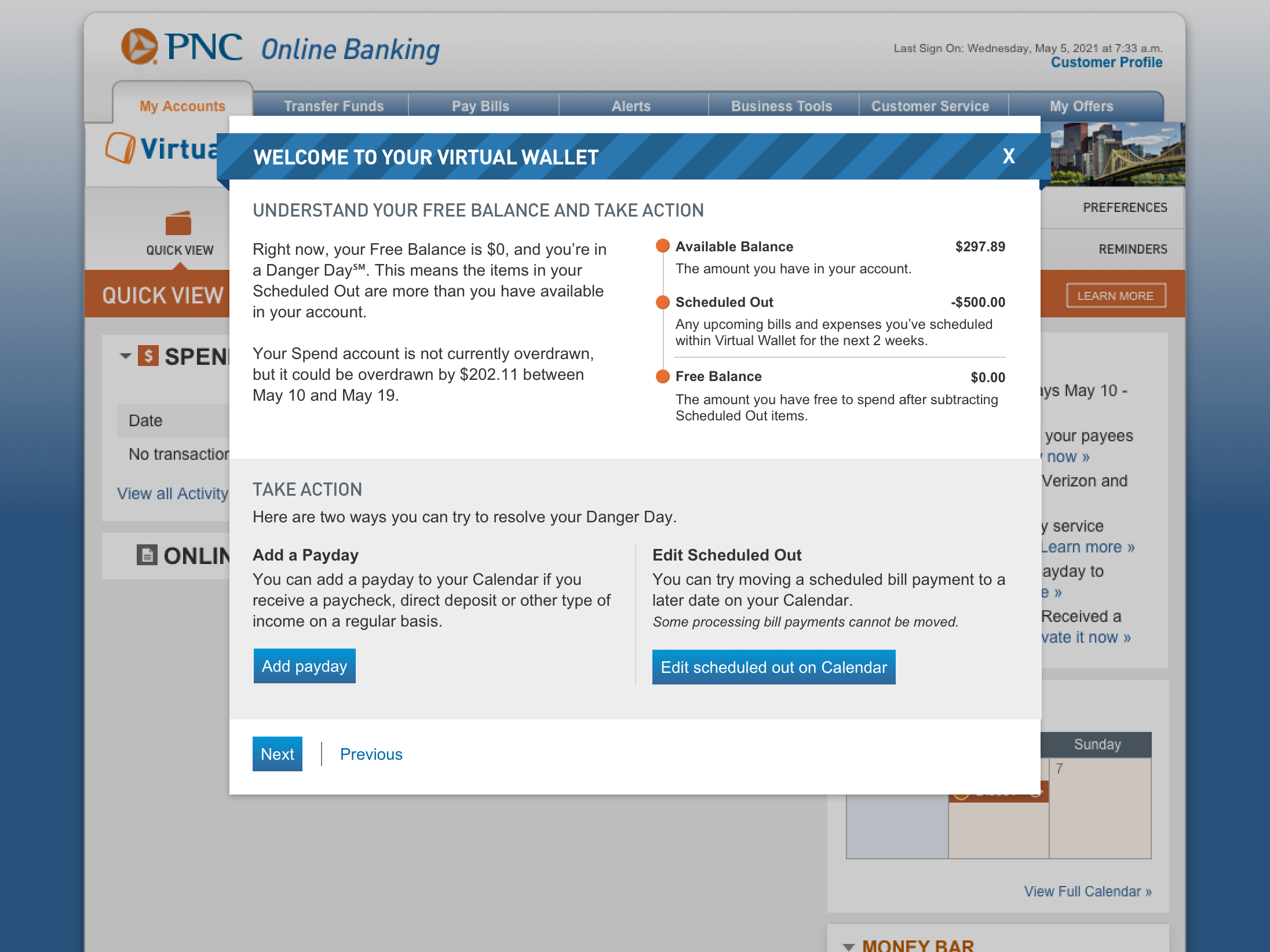

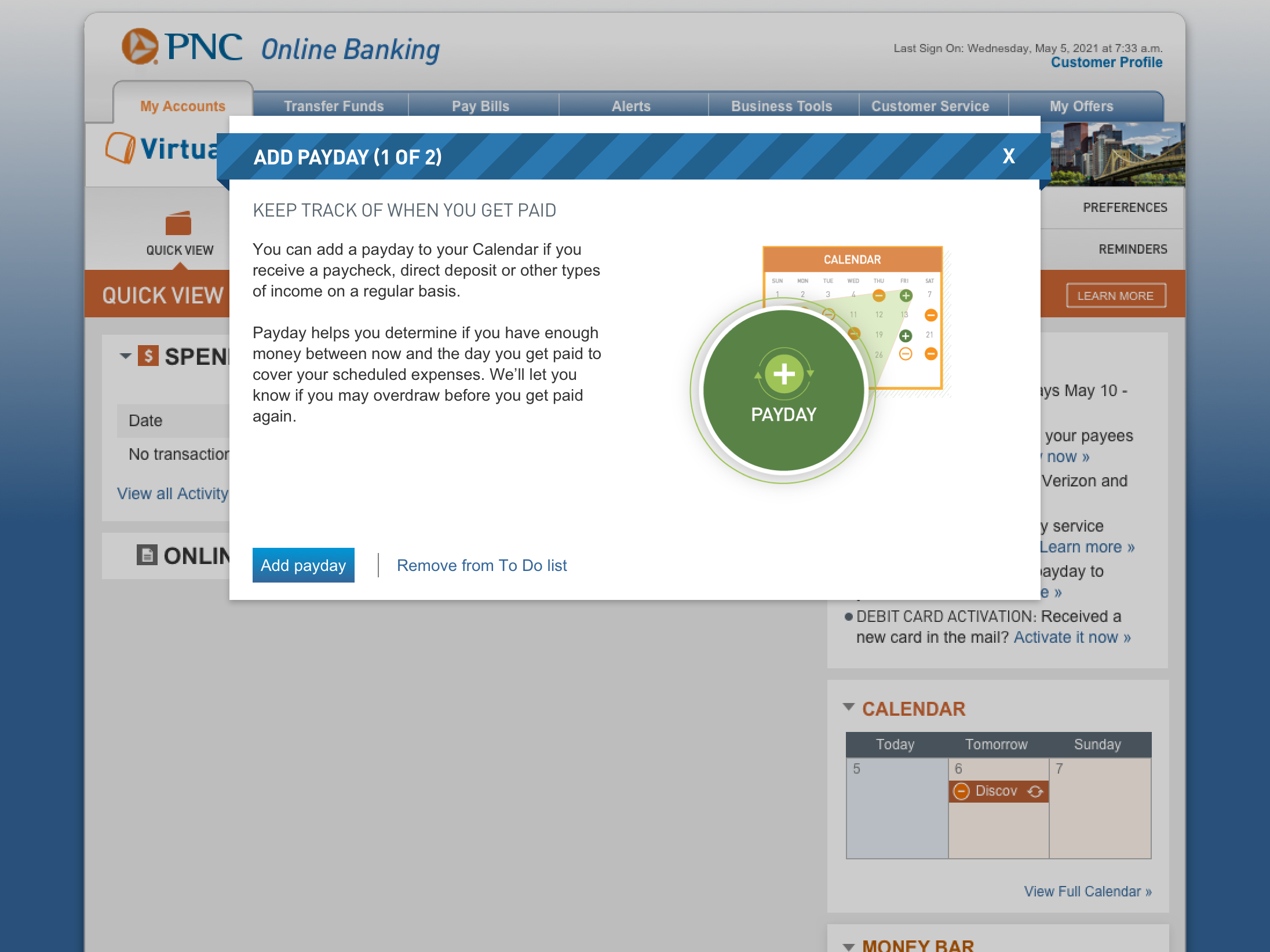

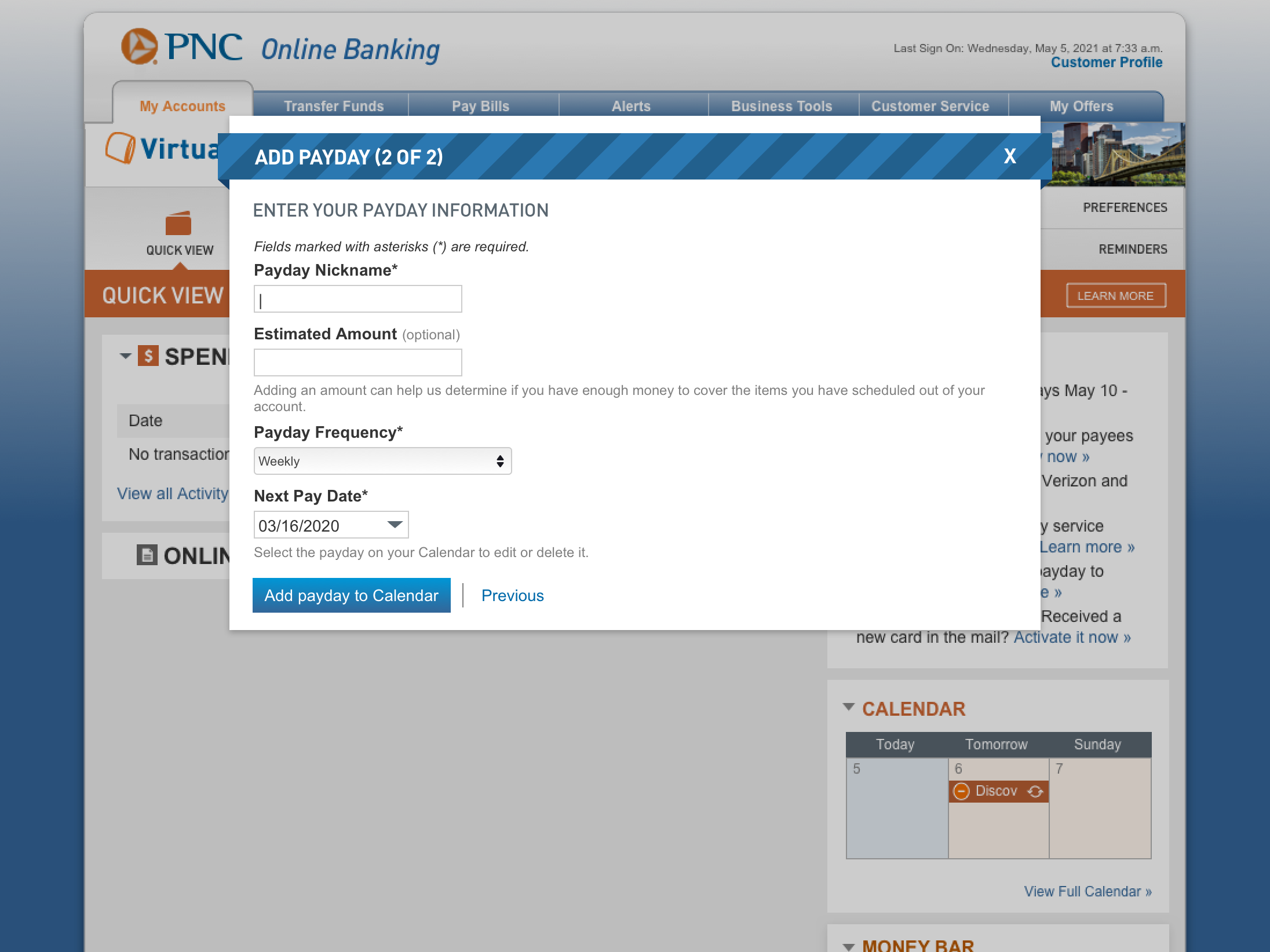

We created a number of flows to help users learn about their new tools, and how to get them set up, including this first time use flow teaching them about Free Balance.

First Time Use and Free Balance

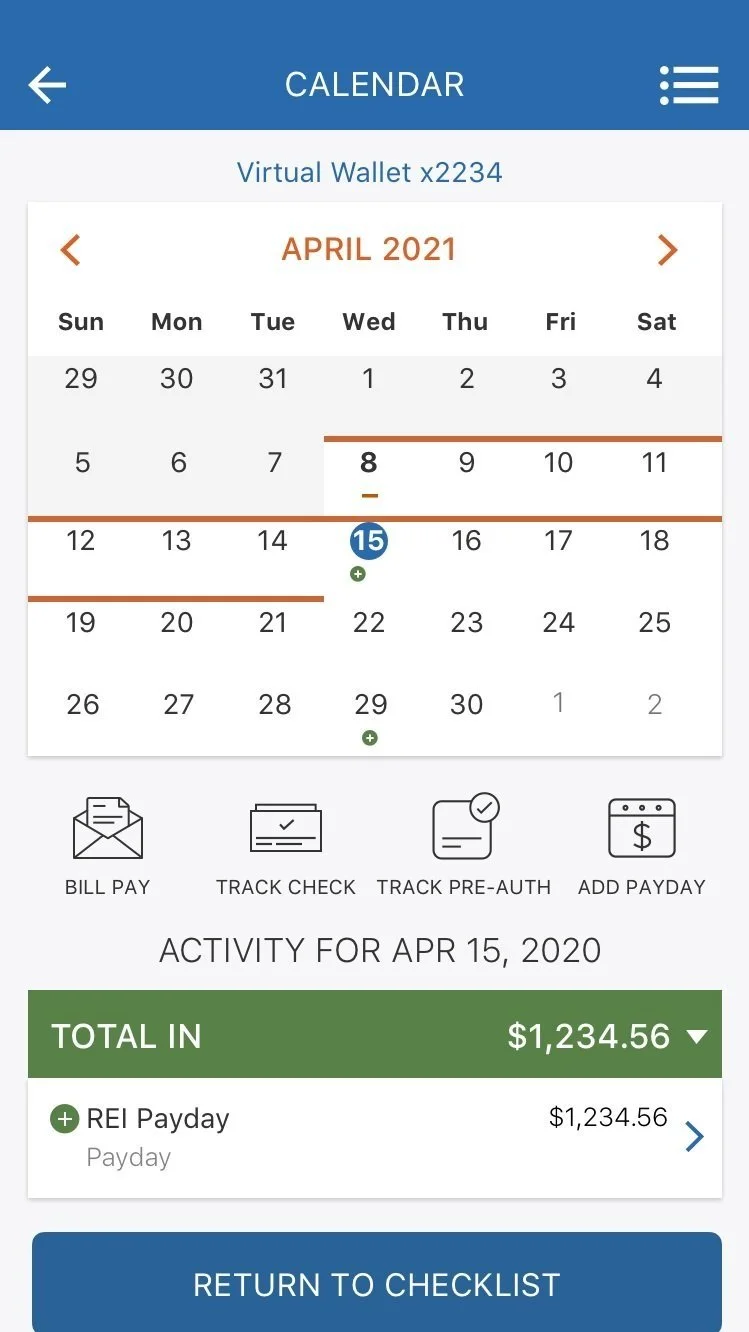

Adding a Payday

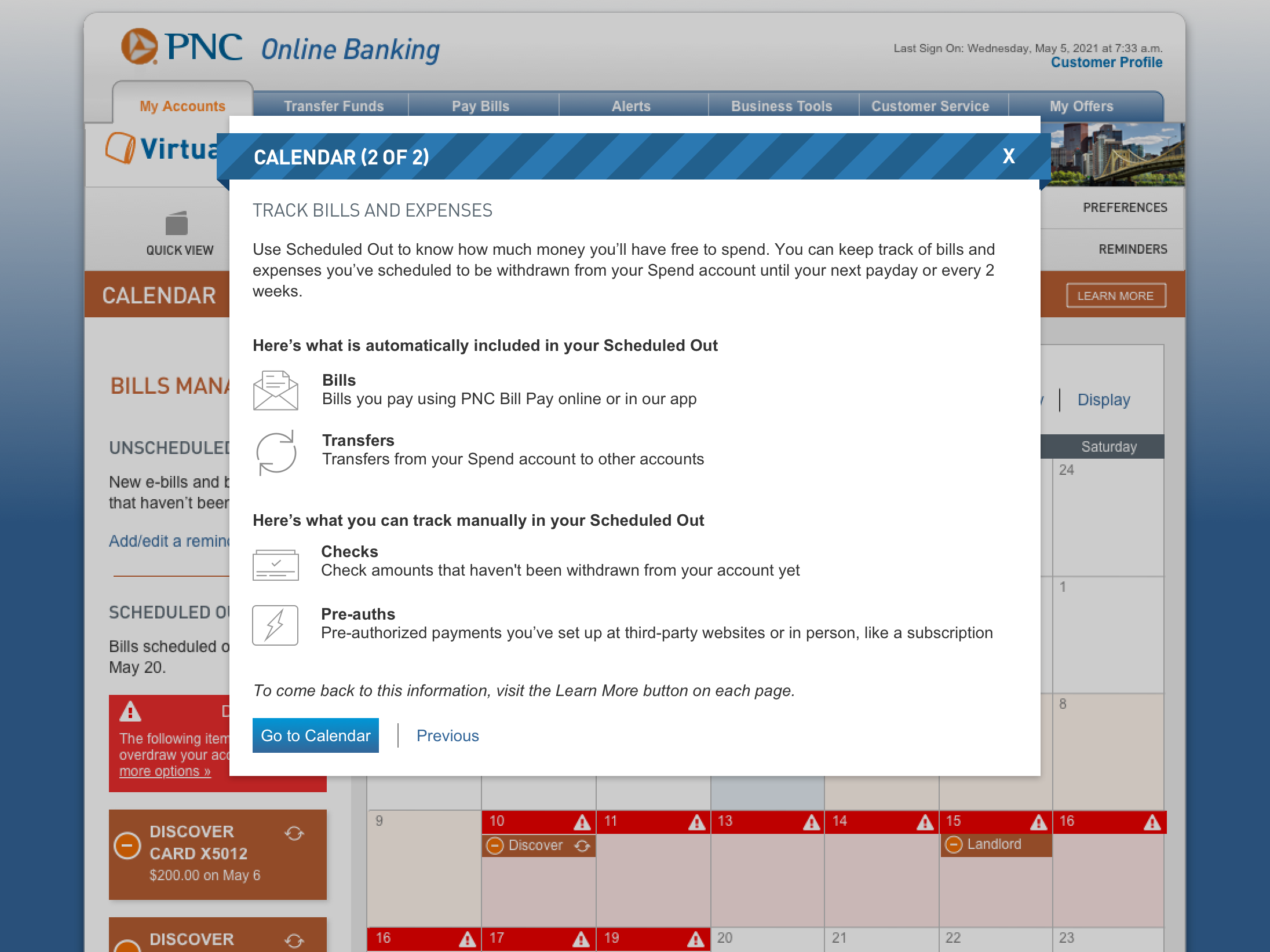

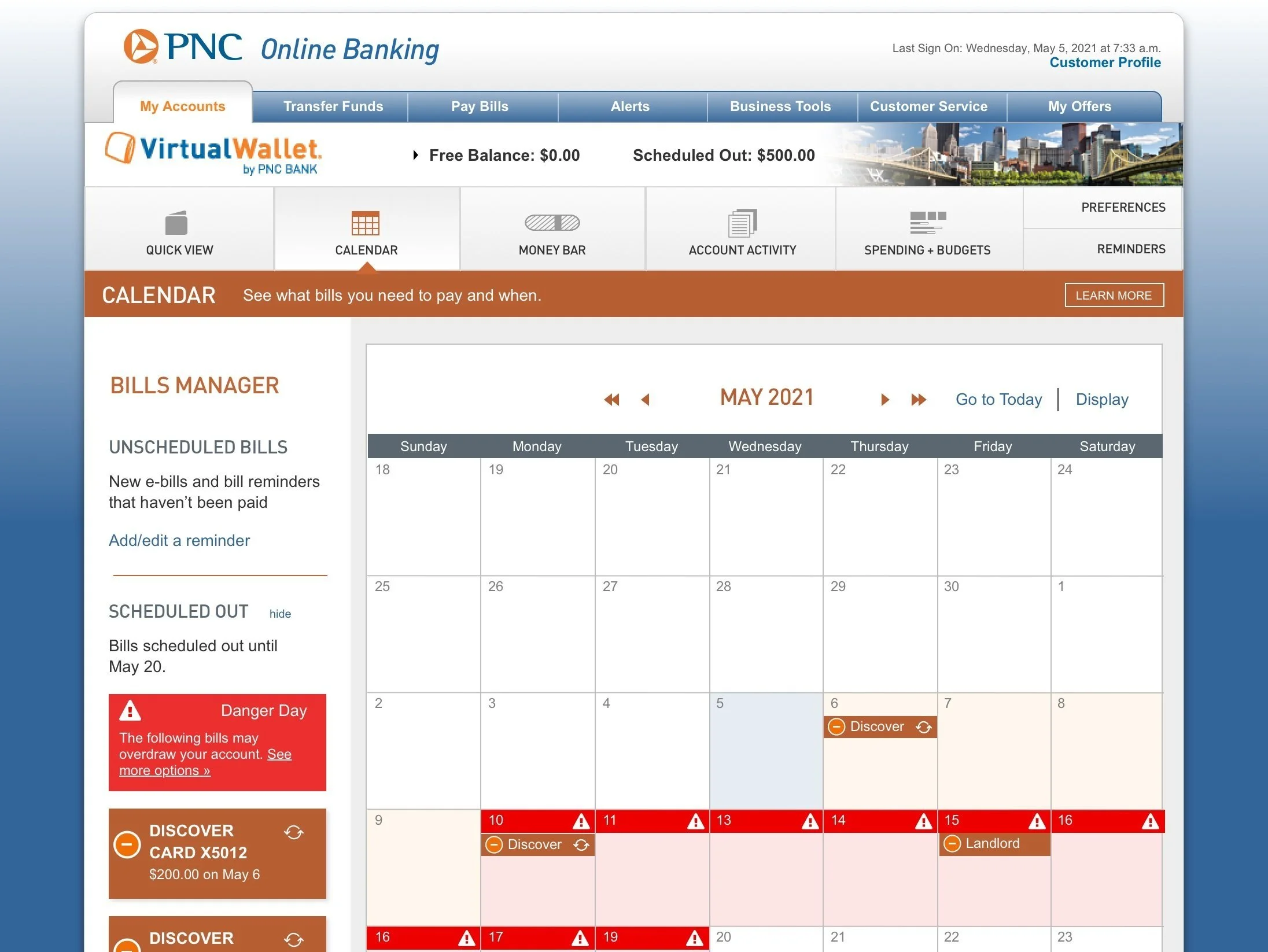

Learning About Calendar

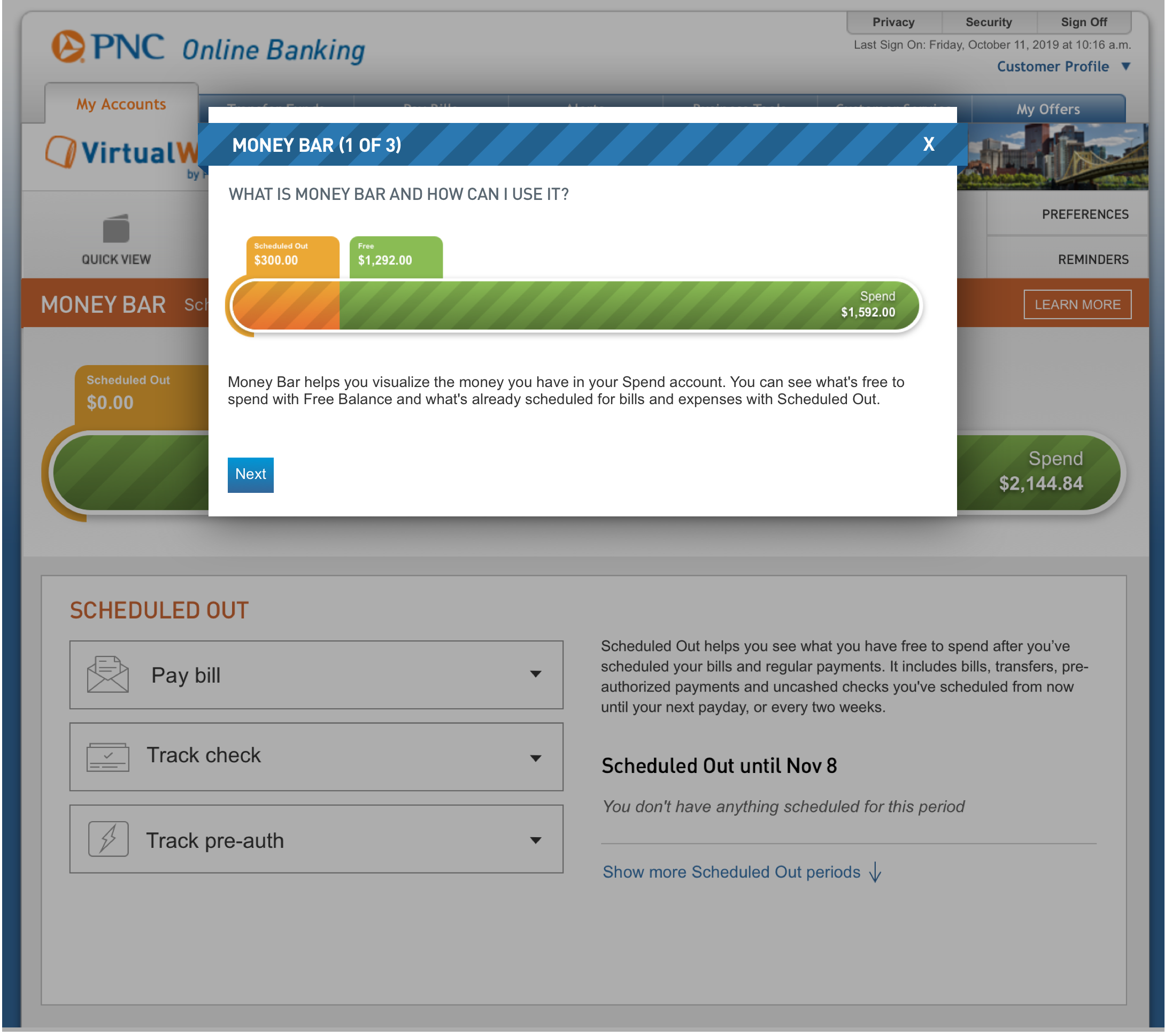

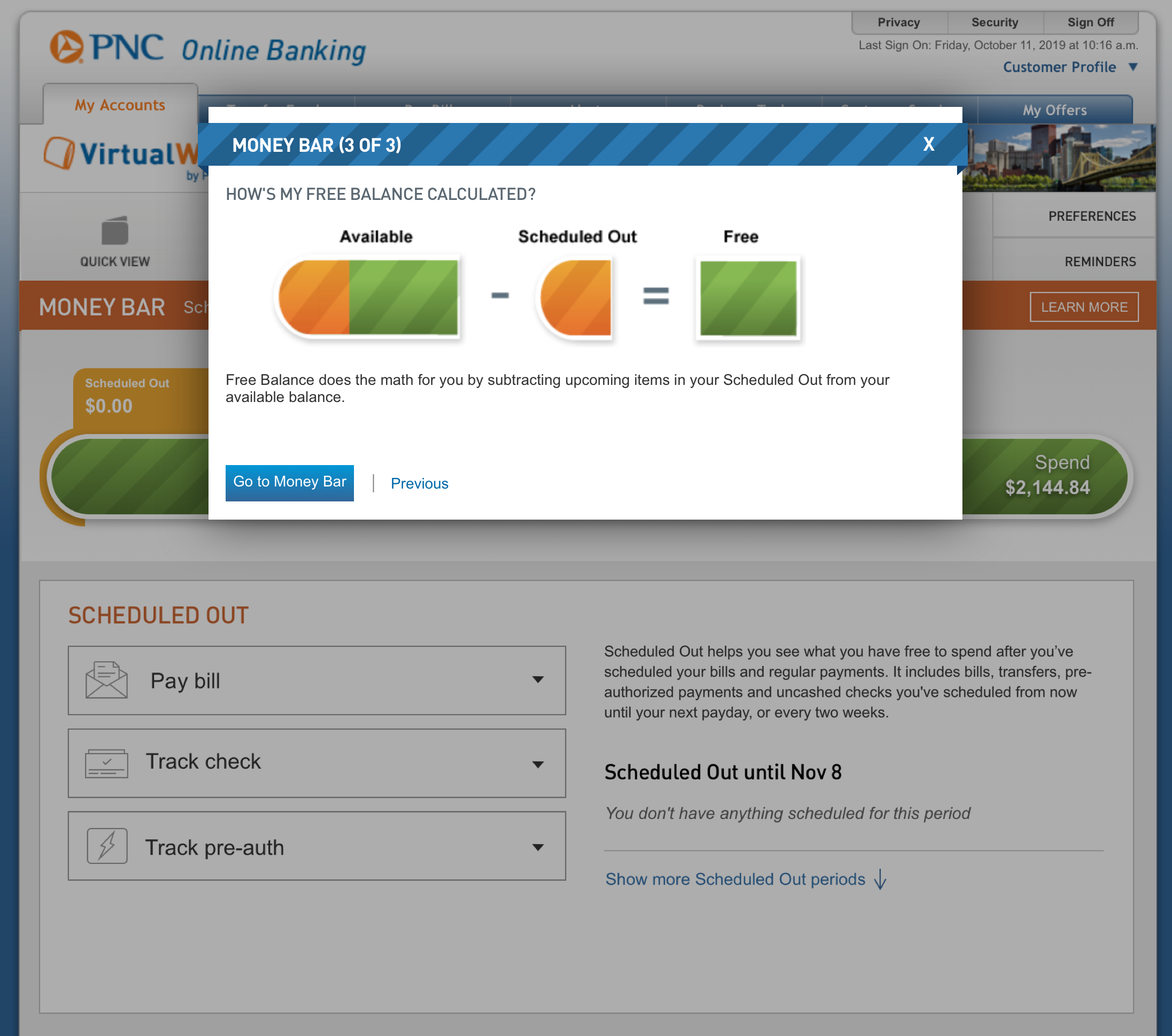

Learning About Money Bar

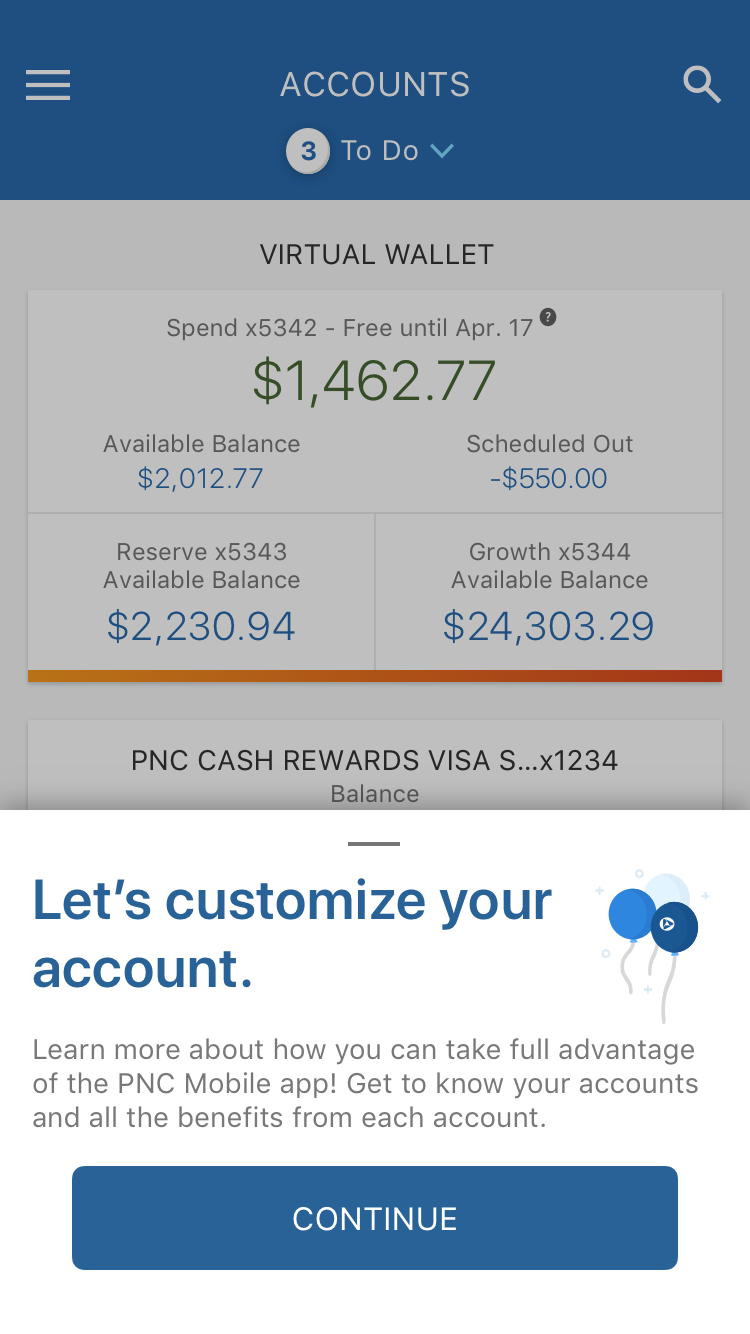

Mobile Onboarding

As mentioned before, our demographic research showed that over 60% of BBVA USA customers were primarily mobile or mobile only users. Because of this, it was important that we provide the same onboarding experiences in our PNC mobile app that we did on PNC.com.

The content is mostly the same as the desktop, with variations to fit the differing information architecture and visual design language of the mobile app. See below for examples of how the above experiences were adapted.